iFAST Financial is committed to safeguard our investors’ online privacy and safety, and we have started this series of Security Advisory articles to enhance investors’ awareness of possible scams and frauds. [First published on July 2023; Updated on Aug 2023]

Impersonation scams have evolved to become more elaborate over the years, and it is important for everyone to remain updated on the latest scam trends, and be aware of the common tell-tale signs to identify such scams to prevent ourselves from falling victim.

According to a news report published on The Business Times on 8 Feb 2023 (Scam victims in S’pore lost S$660.7 million in 2022, almost S$1.3 billion in past two years), three different types of impersonation scams were in the top 10 scam types reported in Singapore over 2021 and 2022, namely fake friend call scams, social media impersonation scams and government official impersonation scams.

These are the different channels that most impersonation scams happen:

1. Phone calls

Such scams are usually conducted through a normal phone call or via call-enabled mobile applications (e.g WhatsApp, Line, Wechat).

The caller may claim to be a:

i. local government official;

ii. staff from a bank or telco;

iii. staff representing courier companies, eCommerce companies;

iv. “friend”.

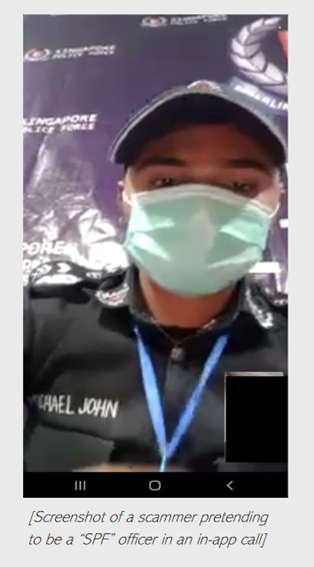

For government official impersonation scams, scammers typically identify themselves as representing law enforcement authorities (eg. Singapore Police Force), government/ministry officials (Ministry of Health (MOH), Ministry of Manpower (MOM), Land Transport Authority, Immigration & Checkpoints Authority (ICA) and etc.).

In more elaborate cases, scammers may initiate video calls while wearing “uniforms” to appear more credible.

Image Source: Singapore Police Force website, Scams Bulletin section, “Trending Scams In The Past Week Issue No 10” (26 May 2023)

Such scammers typically try to intimidate the victims by claiming that the victim had committed criminal offences, or are involved in pending legal or court cases. Some of the reported cases include money laundering offenses, or outstanding fines.

In other cases, the scammers will try to get the victims to provide their personal information, including internet banking details, One-Time Passwords (OTPs), credit card details, and/or other personal information.

Similar tactics were also used by scammers impersonating bank and telco staff, where they may also resort to scare tactics, such as threatening to freeze or terminate the bank/telco account if the requests are not dealt with immediately. For scammers claiming to represent courier and eCommerce companies, they may claim that the goods purchased or on courier require additional fees to be delivered.

Tips when dealing with impersonation call scams:

- Stay calm, stay guarded

o As such scammers claim to represent the authorities, they usually resort to scare tactics in order to pressurize the victims into action, it is important for the victim to remain calm and composed, and not to reveal any personal information or take any impulsive actions.

o Always remember that government agencies will NOT get anyone to transfer monies to an individual’s bank account over a phone call. They also DO NOT request for personal information over the phone.

o Do not click on any links sent by the callers/scammers.

- Verify identity

o Check if the caller’s number are valid, and look out for signs of scams including if the caller ID is showing as “Unknown Caller” or if there is a “+” prefix, or if the call was first made via record messages / automated machines. Do not click on any links sent by the callers/scammers.

o Request for the identity and the number of the caller, and verify their identity via official websites or by calling the hotline of the organisations that the caller claims to be representing.

- Report…

o to the authorities… if you have already provided such information to a suspected scam caller.

o to your bank… if you see fraudulent transactions made with your credit card or bank account.

“Friend call scams”, while not a new scam type, have risen in prominence in recent times:

Image Source: Scam Alert website homepage

When conducting the scam, the scammer calls a victim and identifies himself/herself as a “friend”, and attempt to get the victim to guess his/her name, where the “friend”/scammer will then assume the identity of the name mentioned by the victim. In some cases, the “friend”/scammer will then claim that he/she has lost their mobile phones and request the victim to save the new number. This “friend”/scammer will then approach the victim again to request for financial assistance.

Tips for dealing with such impersonation scams:

- Always check and verify

o Contact the friend via their original phone numbers, to check if they were indeed the caller.

2. Social Media and other social/texting apps

Scammers who make use of social media and/or other texting apps often conduct their scams via the following methods:

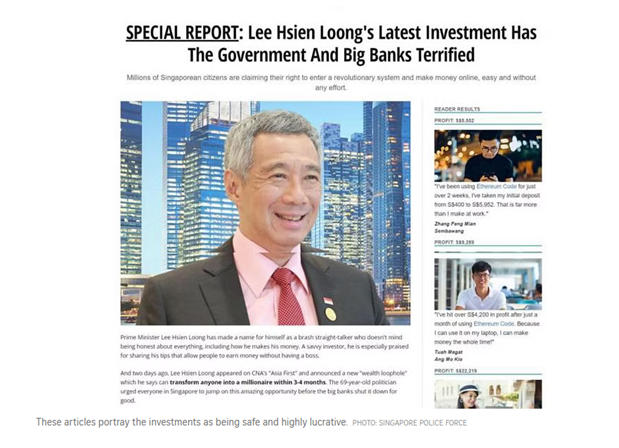

- Some scammers may set up multiple fake social media accounts or fake chat groups, impersonating famous personalities, including celebrities, government officials, political figures, or even the management of well-known companies.

- In some cases, scammers may set up social media accounts to spoof major brands, companies and businesses.

- The scammer impersonates a person by creating a spoofed social media account, and using similar looking profile names and uploading photos of the person.

- Scammers may also hack into or access without unauthorisation the victim’s social media accounts and other messaging apps (eg. Instagram, Facebook, Whatsapp and etc.) to impersonate an individual to target friends in the social media accounts and messaging apps.

For fake social media accounts and chat groups, the scammer may either impersonate a famous personality and company to promote or endorse products and services, or they will try to gain more followers in order to proceed with their next step of scam, including investment scams, or soliciting for financial help.

Image source: “Police warn of fake news of PM Lee endorsing crypto investments”, The Straits Times, 30 April 2022

Image source: “Local celebrity Michelle Chong makes police report over fake keto ad”, The Straits Times, 6 Feb 2023

For scammers impersonating individuals on social media, they may then contact your friends/contacts to add them as “friends”, and subsequently reaching out to them to either request for financial assistance by online money transfers, or to request for personal information, such as banking details and OTPs. In some cases, scammers requested information from the friends/contacts to participate in lucky draws or to claim prizes. Once such information has been obtained, the scammers may subsequently make unauthorised transactions with the financial details.

Tips for dealing with such impersonation scams:

- Look out for signs of impersonation, including badly photoshopped photos or suspicious-sounding indviduals

- Never give your personal information, especially credit card, bank credentials, online shopping details, OTPs and etc.

- Always check and verify

o Contact the “friend” to check if they have indeed been trying to contact you

3. Other online and offline channels

Other than social media and calls, scammers may also impersonate other individuals and companies using emails. Scammers typically send out emails using spoofed domain names that look very similar to the actual name of the organisation that they are representing. Such impersonation emails that may contain phishing or malware links.

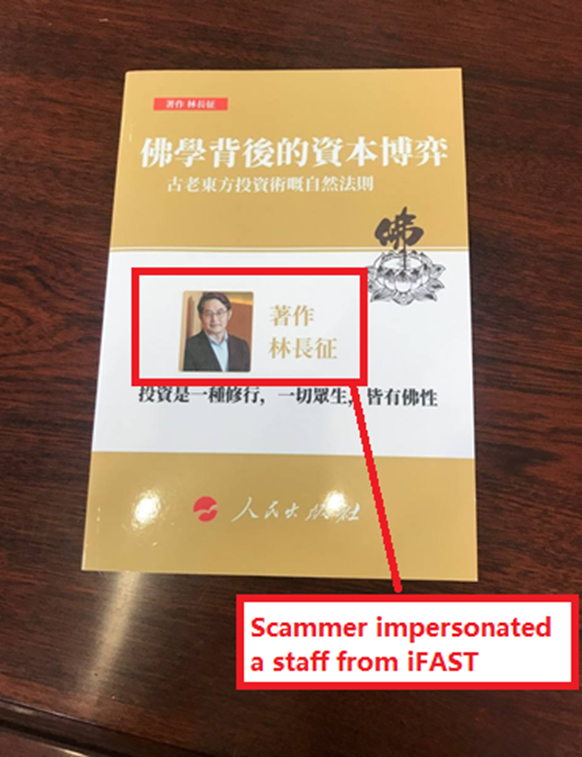

Scammers may also distribute fake advertisement leaflets, posters, brochures, notices or even book publications, in attempts to mislead unsuspecting victims, or to lend credibility to more elaborate scam schemes.

What can impersonation scams lead to?

- Direct monetary loss

Impersonation scammers will either directly request for financial help, including immediate transfer of monies into a bank account, or they will be fishing for personal information such as banking or credit card information and/or OTPs, which they will then utilise to make fraudulent transactions.

- Investment scams

Impersonation scammers who are setting up investment scams typically claim to be associated to a stockbroker or a financial/investment company, or that they are experienced investment professionals, and they will be sending text messages to unsuspecting victims on social media pages or texting apps, including Facebook, Whatsapp, Telegram, WeChat or Line.

i. Some scammers may request for the victim to share personal details, such as personal identification numbers (eg. NRIC and passport numbers) to help to open investment accounts, where the scammer will then get the scammer to transfer their monies to overseas-based banks, and mostly banks based in Hong Kong and China. Some scammers may attempt to sell unregulated investment products and/or cryptocurrencies. The victims may then need to pay hefty fees and taxes in order to receive the profits and returns. Victims may also receive scam phone calls from scammers claiming to represent a government authority (eg. Hong Kong Monetary Authority), who will inform the victim that payments will have to be made before investment profits can be disbursed.

ii. “Pump and dump scams” – The scammers of such scams typically set up social media / text messaging app chat groups, and subsequently sending out invitations for random members to join in. Such social media / text messaging app chat groups may provide insightful investment advice or provide insider information, in attempts to lure more investors to join their groups, and to build up the trust between the victims and scammers. Some scammers may also try to build up friendships or network with the victims by texting them frequently. The scammers will subsequently encourage or coerce the victims into investing in highly volatile products, such as penny stocks. After investing in such products, the share prices will drop drastically, leaving the victims with huge investment losses.

IMPORTANT

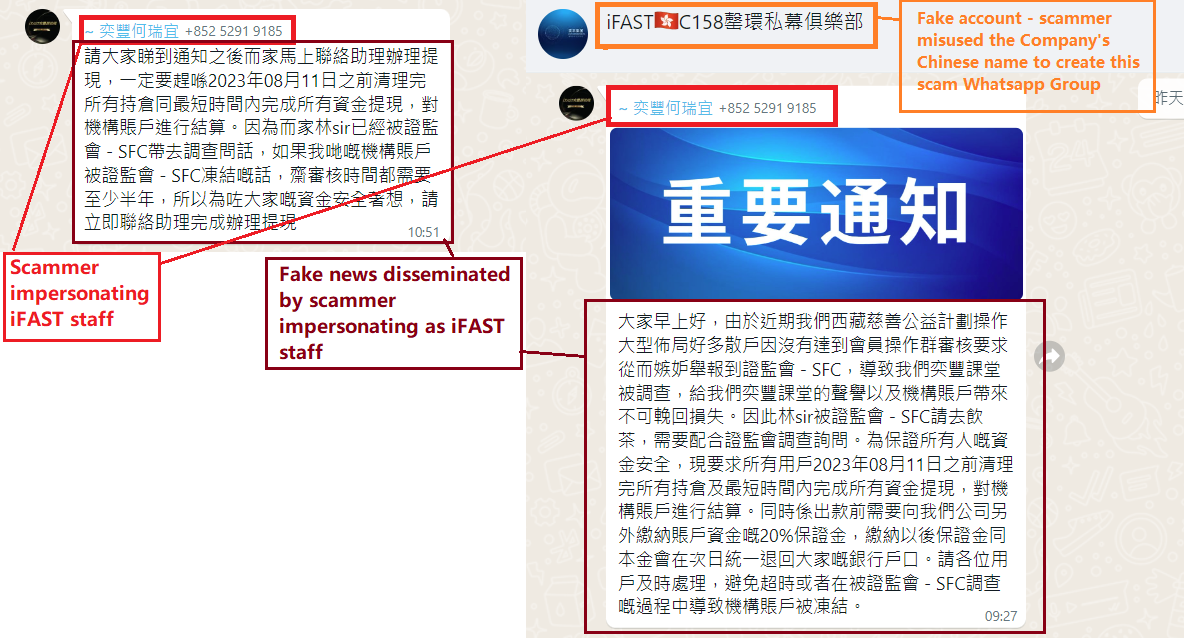

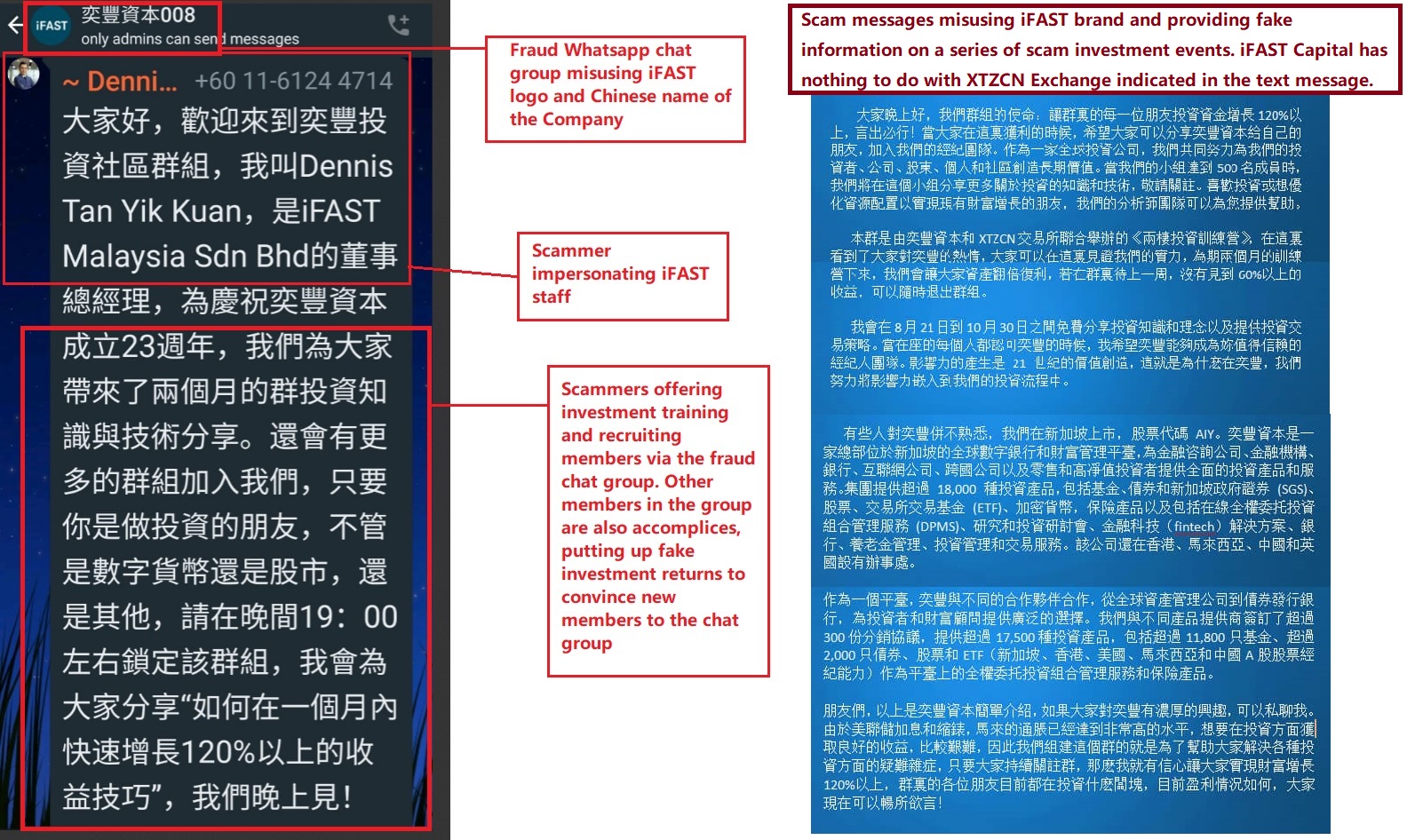

These are some of the recent impersonation scams that have misused the identities of employees under iFAST Corp/iFAST Financial:

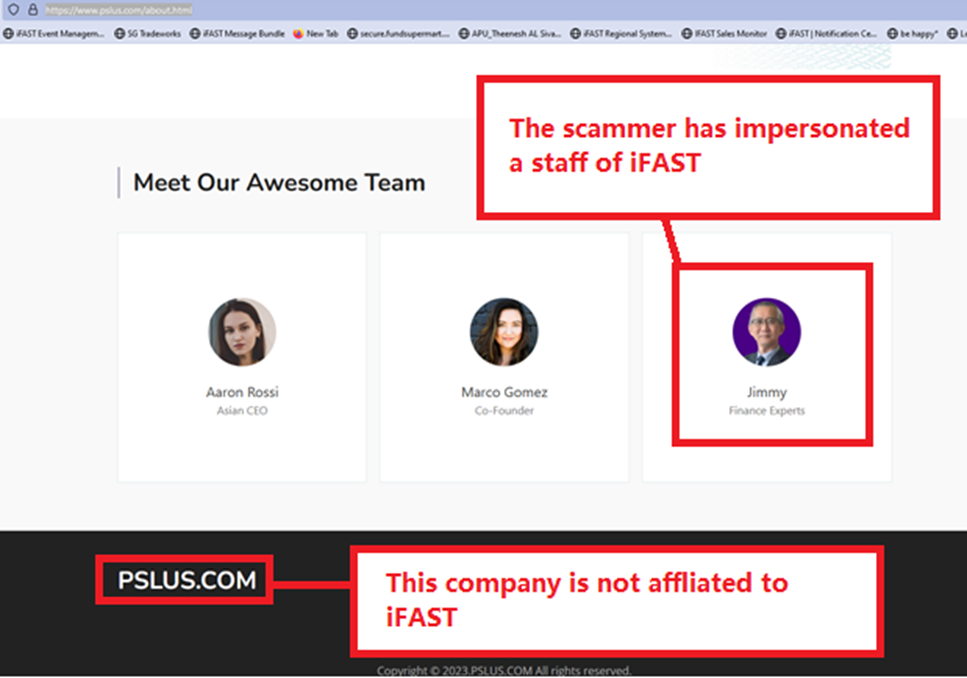

1. The image shows a fake publication misusing the name and photograph of our iFAST Corp’s Management team:

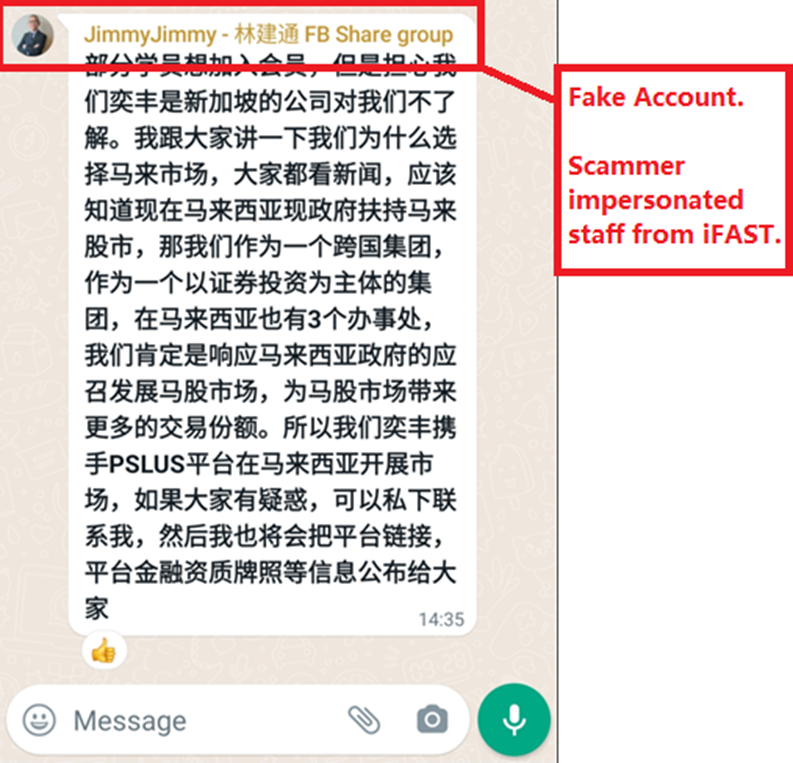

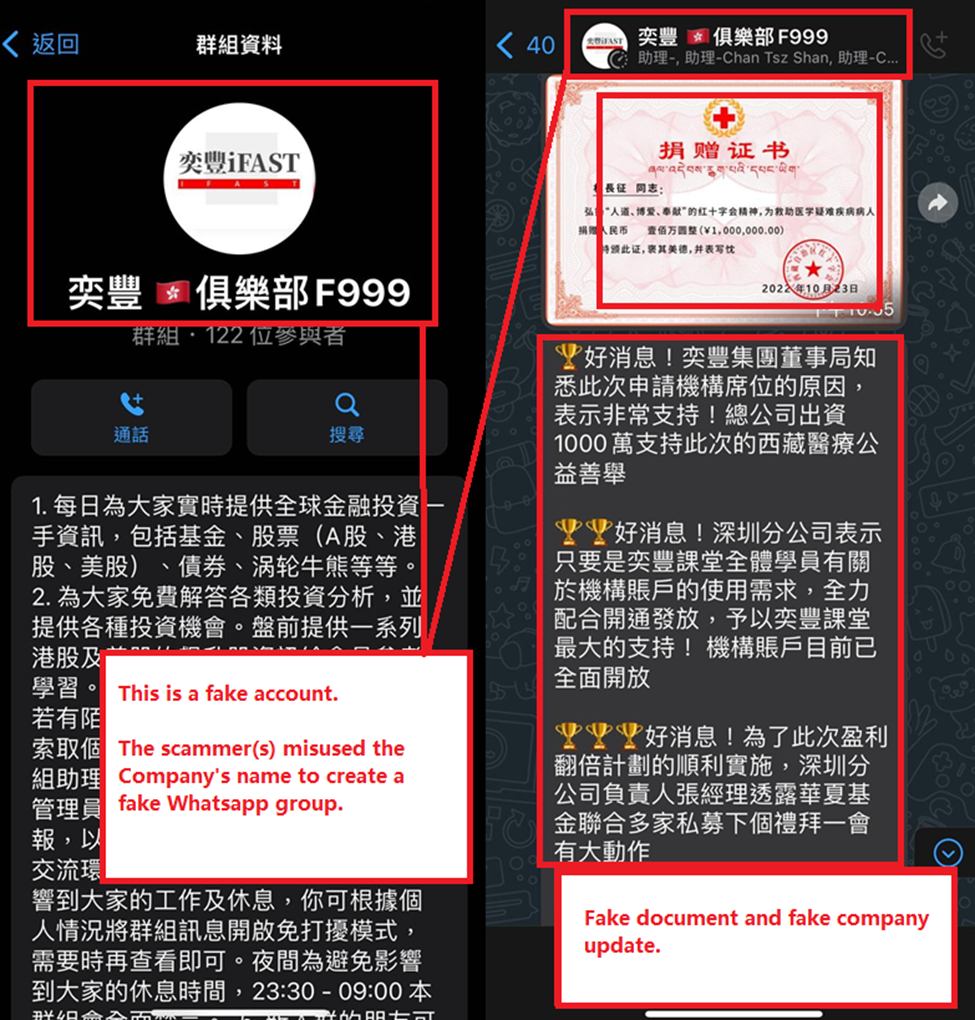

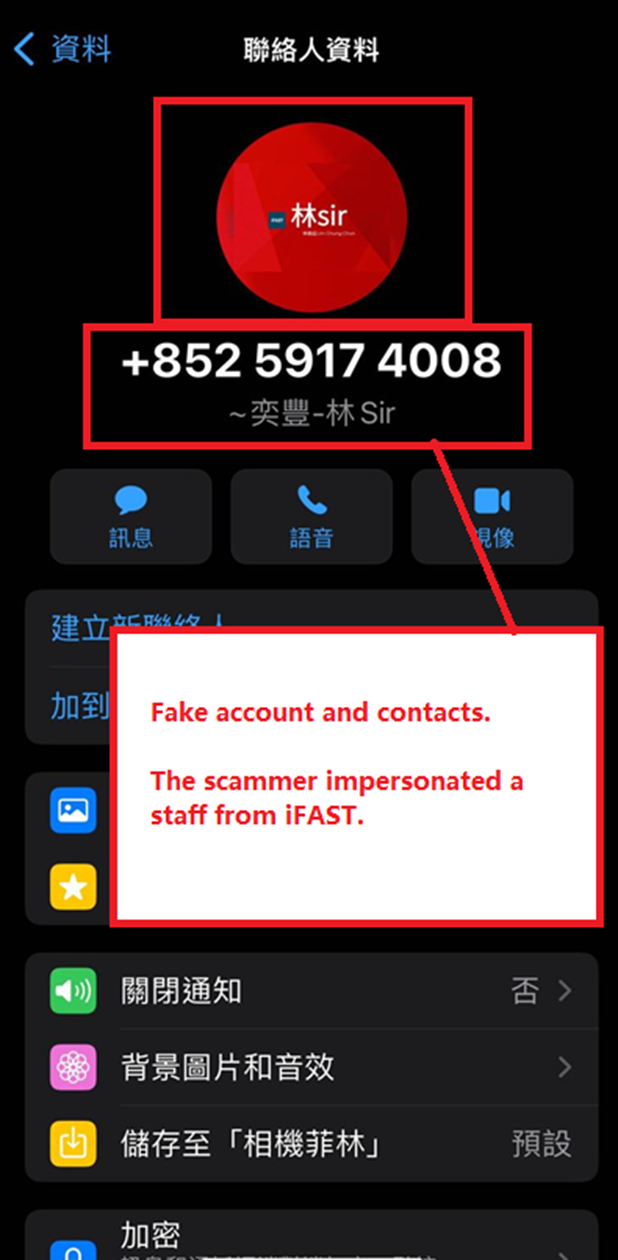

2. The images below show Facebook and chat groups misusing the name and photograph of our iFAST Corp Management.

Other fraudulent groups:

https://www.facebook.com/people/%E6%9E%97Sir/100092172129753/

https://www.facebook.com/profile.php?id=100093248833363

https://www.facebook.com/people/%E5%A5%95%E4%B8%B0%E9%9B%86%E5%9B%A2%E6%9E%97Sir/100092446704594/

3. Fake website and chat group misusing the name and photograph of our iFAST Corp’s Management team, created a similar looking but fake logo of iFAST, and fraudulently claiming to be a subsidiary under iFAST Corp:

4. Other chat groups impersonating iFAST Corp and our Management team.

Find out more about the trending scams on the Singapore Police Force website:

https://www.police.gov.sg/Media-Room/Scams-Bulletin

References:

1. Scam Alert website: https://www.scamalert.sg/

2. Singapore Police Force Scams Bulletin website: https://www.police.gov.sg/Media-Room/Scams-Bulletin

a. Trending Scams In The Past Week Issue No 13 (Published on 16 Jun 2023): https://www.police.gov.sg/-/media/622C1AE88B474425972498D3A0E091BD.ashx

b. Trending Scams In The Past Week Issue No 10 (Published on 9 Jun 2023): https://www.police.gov.sg/-/media/8A77607EBFE94034B4CD3C3353E69B83.ashx

c. Trending Scams In The Past Week Issue No 10 (Published on 26 May 2023): https://www.police.gov.sg/-/media/60EFC5C4EAA34356B4A1CA24B59600D6.ashx

3. Scammer, Beware: Building:

To find out more about iFAST Corp, contact us at (65) 6535 8033 or visit our website at www.ifastcorp.com

Singapore • Hong Kong • Malaysia • China • India