Proprietary Technology that Propels Innovative Financial Services to New Heights

Developing IT capabilities in-house has been iFAST Corp’s key focus since the Company’s inception in 2000, and this has powered the Company to create innovative Fintech solutions for our customers and partners. iFAST Corp also understands the importance of Cybersecurity and is committed to maintaining a high level of IT security for its online platforms to protect and safeguard its stakeholders’ interests.

For iFAST Corp, the spirit of “Fintech” has been established since the early days of our business. We started as a relatively small financial services company in the year 2000 with the rollout of FSM in Singapore, and we had to create a strong impression on the investor community. Armed with our belief that the investor community was not being offered the best investment experience, we worked hard to create an FSM portal that could make a positive difference with investors, with our emphasis on transparency and research. The engine that made all the different components come together and run smoothly was our IT system.

Our management team was clear that for us to make a difference in the life of investors and wealth advisers, we have to build an innovative and robust IT system that constantly propels our platform services to new improved levels. From the early days of our business, we have built our IT solutions in-house. The guiding principle behind having our IT team in-house is that for innovative services and solutions to be made regularly and rapidly, we must provide our IT teams with a progressive working environment.

Over the years, with a strong frontend and backend system, and progressive developments on our websites and mobile applications, we have been able to deliver reliable and innovative services to our customers. With our business and operations largely Internet-based, we believe our focus on the continual enhancement of our systems, initiatives such as improving the ease of navigation and transactional capabilities, as well as improving user experience and interface, will help us remain competitive in both our B2C and B2B business divisions. Improvements in IT offerings also help to lower cost and improve speed of delivery of our services to clients. Our dependency on external IT services and maintenance can be significantly reduced, and we are also able to speed up the process to develop and roll out new IT initiatives.

Innovation: Powered by Fintech and AI

Innovation remains a core value at iFAST Corp, playing a pivotal role in sustaining competitiveness and ensuring relevance in the dynamic financial industry. By developing the majority of its IT capabilities in-house since inception, the Company has been able to deliver cost-effective solutions with swift turnaround times, enabling the timely launch of innovative products and services across its platforms.

Empowering Fintech Growth with IT Partnership

Innovation remains a core value at iFAST Corp, playing a pivotal role in sustaining competitiveness and ensuring relevance in the dynamic financial industry. By developing the majority of its IT capabilities in-house since inception, the Company has been able to deliver cost-effective solutions with swift turnaround times, enabling the timely launch of innovative products and services across its platforms.

Established in 2015, the iFAST IT Partnership (“ITP”) empowers IT personnel to propose and lead projects independently, fostering a culture of entrepreneurial ownership while ensuring proper incentives for innovation and system enhancement. This structure is modelled after the partnership frameworks used in audit and law firms, enabling ITPs to drive growth and elevate technological advancements for the benefit of both clients and employees.

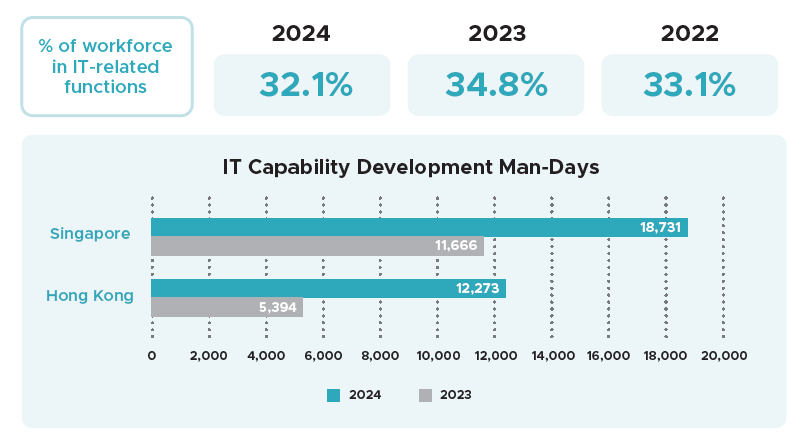

As of 2024, the Group has a total of 15 ITP teams, alongside other IT-related teams, including the ITP Committee Team, IT Infrastructure, IT Applications, and UI/UX teams. The percentage of IT-related workforce has consistently remained above 30% of the Company’s total workforce in recent years, reflecting iFAST Corp’s commitment to technological excellence.

In 2024, there was a notable increase in man-days dedicated to IT capability development and maintenance in both Singapore and Hong Kong. The rise in Hong Kong was particularly significant, largely driven by the progress of the ePension project. This reflects the organisation’s continued investment in strengthening IT infrastructure and digital transformation efforts across key locations.

Building a Resilient IT Infrastructure for Fintech

A robust and resilient IT infrastructure is fundamental to iFAST Corp’s ability to deliver and advance Fintech solutions for its customers and business partners. The Company has continuously strengthened its systems monitoring and enhancement processes, ensuring the uninterrupted availability of critical systems, including those supporting client trading and information access.

In 2024, iFAST Corp successfully maintained its maximum unscheduled downtime for critical systems below the four-hour limit set by the Monetary Authority of Singapore (MAS) within any 12-month period. The Company remains committed to dedicating further resources to the enhancement and maintenance of its IT infrastructure, ensuring customers experience minimal disruptions.

Additionally, iFAST Corp continues to closely monitor key IT infrastructure metrics and system performance to uphold reliability, security, and operational efficiency across its platforms.

Enhancing IT Capabilities - Improved Operations, Greater Efficiency

iFAST Corp believes continuous innovation and enhancements in its platform functionality and user experience will empower the Company to remain competitive and stay in the forefront within the global digital banking and wealth management space.

iFAST Corp remains committed to enhancing customer experience by streamlining transactional and operational processes while improving platform navigation. Over the years, the Company has consistently introduced new IT projects aimed at improving operational efficiency and accessibility.

In 2024, iFAST Singapore enhanced its SGD Auto-Sweep with the iFAST SGD Enhanced Liquidity Fund to facilitate an innovative T+0 settlement cycle. Customers who have submitted their subscription instructions before the cutoff time on a business day, will be able to receive the underlying units within the same day. Similarly, customers who have submitted their withdrawal instructions before the cut-off time will receive the sales proceeds in the same day. Applicable securities transactions on US exchanges have also transited to & a T+1 settlement cycle in 2024, enabling investors to receive their sales proceeds one business day earlier.

Following the launch of Product Financing services for Accredited Investors on the Singapore iFAST Global Markets (iGM) platform in 2023, the same service was launched on the Singapore and Hong Kong B2C divisions in 2024, allowing accredited clients to leverage up to 3.5 times their assets across seven currencies, providing greater investment flexibility to optimise portfolios and enhance returns.

In Singapore, FSMOne.com clients who meet the eligibility criteria will be able to opt-in to the service after logging in to their account, and they will enjoy instant approval without having to submit additional documentation. Upon opt-in, the collateral value of the clients’ entire FSMOne.com portfolio will be assessed, and a unified margin buying power will be shown for them to begin trading utilising the Product Financing services. This service enables clients to optimise investment strategies by leveraging financing options without depleting cash balances.

With iFAST’s recent business expansion into UK, and aligned with the Group’s vision of establishing a truly global business model, iFAST Hong Kong and UK-based iFAST Global Bank (“iGB”) launched iFAST Global View in 2024. With iFAST Global View, clients with an iGB account can easily link their iFAST wealth management accounts within the iFAST ecosystem. Investments and digital banking balances across borders are combined within one consolidated viewing page, empowering clients with the ability to view their wealth management and digital banking accounts. Additionally, customers will also be able to perform “Global Transfer” between their different iFAST accounts across multiple regions.

The Hong Kong iFAST Fintech Solutions team has also developed a TreasuryNow API Solution, designed specifically to meet the needs of institutions and securities firms by providing streamlined access to the US Treasury market. The goal in creating this solution is to help business partners diversify their offerings to serve a broader range of clients while ensuring operational efficiency. The integration of this API solution will also provide stable investment options for investors seeking security and reliability.

Driving Innovation with Transparency and Accessibility

Innovation and transparency remain at the core of iFAST Corp’s business strategy, shaping its proprietary technology capabilities and commitment to open access and fair pricing. The Company has consistently focused on enhancing information accessibility, ensuring that investors can make well-informed financial decisions. Unlike many platforms that restrict access to account holders, iFAST Corp provides public access to research content, investment tools, and product information, allowing all investors to search, compare, and analyse financial products before making investment decisions. Key platform features such as Chart Centre and various product selectors/screeners continue to be widely used by the investor community at large.

In 2024, on the Singapore B2C FSMOne. com platform, the popular Fund and ETF selector was further enhanced, enabling investors to explore lists categorised by themes, popularity, and market megatrends. Customised filters can be applied to the selector results, which can then be saved, exported or shared.

Enhanced stocks/ETF calculator features include a new “Return & Growth” section which allowed investors to view the capital gains received from price appreciation as well as a breakdown of the total dividends received for a selected stock/ETF. The “Profit & Loss” section shows investors the profit or loss incurred for a selected stock/ETF with processing fees factored in, and for investors currently sustaining losses, the new feature can also show a price target for the stock/ETF to breakeven.

Investors are also able to view the most popular Funds, Stocks, and ETFs among FSMOne.com clients for the current week, enabling them to quickly identify trending investment ideas and stay informed about the latest market trends.

The ETF RSP service, first introduced on FSMOne.com in 2019, has provided investors with a cost-effective way to adopt the dollar-cost averaging strategy. With no commission fees, investors can start their ETF RSP investments at regular intervals with minimal costs. As at end December 2024, the list of ETFs available for RSP has expanded to 269 ETFs, offering greater investment choices. The Company aims to further broaden this selection in the coming year to cater to increasing investor demand.

As the newest addition to the Group, iGB has prioritised service enhancements to strengthen and further develop services on its EzRemit, Digital Transaction Banking (DTB) and Digital Personal Banking (DPB) divisions.

In 2024, building on its established EzRemit division, iGB integrated crosscurrency international payments with both DPB and DTB divisions. This service enables customers to transfer funds swiftly and cost-effectively to over 50 countries in more than 25 currencies. Many transfers are completed within minutes, with most processed within 48 hours, offering real-time exchange rates and fee-free transactions. Instant FX Trading was also launched on the DTB platform across eight currencies for corporate banking accounts, where Small-Medium Enterprises, Electronic Money Institutions, APIs, and payment providers will be able to manage their accounts and FX seamlessly through the DTB platform.

Optimising Payment Processes and Debit Card Services

As part of iFAST Corp’s ongoing digitalisation efforts, the Company has streamlined platform processes involving cash and cheque payments, gradually phasing out cheque transactions across its Singapore platforms. Beyond offering greater convenience to customers, this transition has contributed to sustainability efforts by reducing paper usage and carbon footprint. The elimination of cheques, envelopes, additional paper forms, and the need for physical cheque postage and deposits has significantly minimised waste and emissions.

iFAST launched Debit Card services on Singapore FSMOne.com and iGM platforms in 2022 and 2023 respectively, enabling customers to invest, insure, and seamlessly make purchases using their investment proceeds, dividends, and available balance in their Cash Account, both online and at any merchant accepting Mastercard. This new service also enabled customers to utilise their Cash Account balance without having to withdraw monies back into their bank account. In 2024, enhancements were planned to enable the Debit Card to deduct from both the SGD Cash Account and Auto-Sweep Accounts, and this new feature has been launched in 1Q2025.

After the launch of the SGD Auto-Sweep account in 2019, iFAST Singapore continued to expand into different Auto-Sweep currency classes, launching the CNH and USD Auto-Sweep account in 2022 and 2023 respectively. In 2024, Auto-Sweep accounts were launched on both Hong Kong and Malaysia platforms, enabling investors in these two markets to enjoy the benefits of an innovative cash management solution which serves as a convenient payment method, and may also help investors earn potentially higher yields on their idle cash. As of end December 2024, the HKD and USD Auto-Sweep accounts are available in Hong Kong, while the SGD and USD Auto-Sweep accounts are available in Malaysia.

In 2024, following further system enhancements in iFAST Singapore platforms, all three currency Auto- Sweep accounts can now be utilised for Regular Savings Plan (RSP) payments, offering a seamless, efficient and automated payment facility for customers who are looking to invest into unit trusts and ETFs utilising a dollar-cost averaging strategy, while also earning potentially higher yield on the monies parked in the cash management solution accounts.

Similarly, the Singapore FSMOne.com platform also enabled SRS as a payment method for ETF RSPs to provide investors with more options to invest their SRS monies in a disciplined manner.

Cybersecurity: Building a Secure Digital Future

iFAST Corp is committed to implementing the best cybersecurity measures throughout the organisation to safeguard the interests of all stakeholders, including customers, employees, product and service providers, and business partners.

Cybersecurity Governance and Strategy

iFAST Corp adopts a holistic and proactive approach to cybersecurity, integrating industry best practices from organisations such as the International Standardisation Organisation (ISO) and the National Institute of Standards and Technology (NIST). The Company’s cybersecurity framework is designed to safeguard its IT infrastructure, ensure regulatory compliance, and mitigate emerging cyber threats.

Cybersecurity controls and measures are regularly audited by internal teams and external agencies to promptly address any identified vulnerabilities. Additionally, iFAST Corp continues to invest in resources and expertise, including attracting top cybersecurity talent and integrating new security technologies, to strengthen its cyber defences and enhance resilience against evolving threats.

Cybersecurity Risk Management

iFAST Corp recognises that as a Fintech platform, its operations are highly dependent on technology, making cybersecurity a critical priority. Any compromise or failure due to cybersecurity lapses could have a significant impact on the Company’s business and reputation.

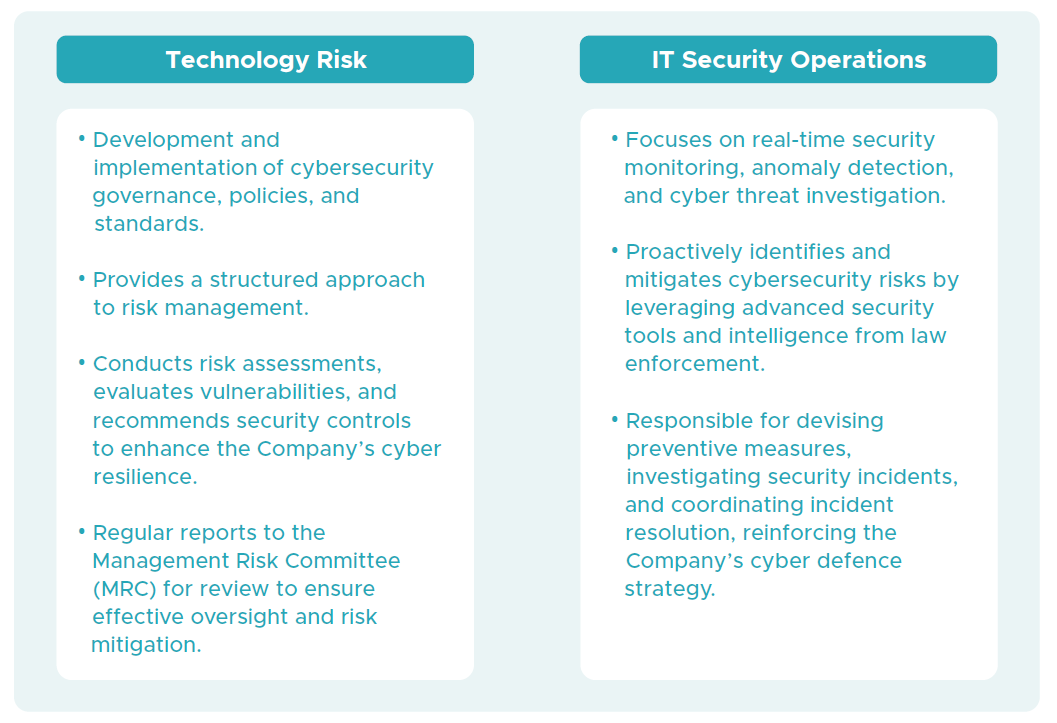

To mitigate these risks, the Company has established two dedicated departments: Technology Risk (Tech Risk) and IT Security Operations (SecOps), each playing a crucial role in mitigating cyber threats and ensuring operational resilience.

Through these dedicated teams, iFAST Corp maintains a robust cybersecurity framework, ensuring compliance, risk mitigation, and business continuity in an evolving digital landscape.

Protecting Customers and Strengthening Digital Trust

iFAST Corp is committed to safeguarding customers’ online transactions by implementing robust security measures across its wealth management platforms and digital banking services. All transactions are processed with strict security protocols and end-toend encryption, aligning with the global security standards used by leading financial institutions.

Account Security with Multi-Layered Authentication

To enhance security, iFAST Corp has implemented multi-layered authentication across its platforms. Since 2015, the Company has enforced Two-Factor Authentication (2FA) upon login to prevent unauthorised access and transaction modifications. Over the years, security features have evolved to include biometric authentication, allowing customers to use fingerprint or facial recognition for secure logins.

Over the past four years, iFAST platforms, including iGM and FSMOne. com, have integrated digital token authentication within their mobile applications. This feature enables customers to link their devices as Digital Tokens for 2FA authentication, offering greater convenience and cost savings compared to traditional SMS-based authentication.

To further protect customers from unauthorised access, the Company has introduced enhanced email notifications. Customers logging in from a new device, an incognito session, or a private browser tab receive real-time email alerts, notifying them of the new login attempt and enhancing account security monitoring.

Scam Prevention and Customer Education

As scams targeting individuals and investors continue to evolve, iFAST Corp has implemented proactive initiatives to help customers identify and mitigate these risks. Since 2022, FSMOne.com has maintained a dedicated Online Security Page, serving as a central hub for cybersecurity education, featuring regular updates and practical security tips.

In 2024, iFAST Corp further expanded this resource by regularly publishing cybersecurity content and in-depth articles on impersonation scams, fraud tactics, and preventive measures. These insights are actively shared via iFAST websites, platform notifications, and social media channels, ensuring customers stay informed and vigilant. The company aims to continue this initiative as a quarterly publication in 2025.

To enhance fraud response, the Company has streamlined scamhandling processes, establishing an efficient workflow that leverages multiple channels for prompt action against fraud. This includes targeted measures to combat SMS and email phishing, reinforcing iFAST Corp’s commitment to customer protection and digital security.

Scam Prevention and Customer Education

iFAST Corp has strengthened its commitment to safeguarding IT systems by ensuring data access is strictly limited to a need-to-know basis. In addition to implementing robust cybersecurity measures, the Company proactively educates customers on best practices to protect themselves against online scams and cyber threats.

Leveraging AI for Cybersecurity and Operational Efficiency

With the rise of Generative AI and AIdriven cyber threats, iFAST Corp has integrated AI-powered cybersecurity solutions to enhance threat detection and mitigation capabilities. The SecOps team leverages advanced AI-driven systems to detect, analyse, and mitigate sophisticated cyber threats in real time.

In parallel, the Company encourages employees to leverage AI tools to improve productivity while ensuring responsible usage. The Tech Risk department provides training on secure AI adoption and has developed an AI Security Whitepaper to guide the development of AI-backed IT projects within the Company.

Data Security and Cyber Resilience

To maintain restricted data access and protect the Company’s systems from unauthorised entry, iFAST Corp has implemented rigorous internal access controls. Employees are granted access only to information relevant to their roles, following a strict approval process that ensures proper authorisation for access control.

The Tech Risk team conducts regular reviews of internal access controls across various systems, assisting departments in determining data sensitivity and advising on appropriate security controls. Additionally, the department provides information security consulting services to support teams across the organisation. The Company has consistently met its internal target of reviewing authorised access annually, with similar reviews scheduled to continue each year.

To further enhance cybersecurity monitoring, iFAST Corp has established IT security policies designed to detect unauthorised information processing activities.

Security systems undergo regular monitoring, and information security events are logged to enable the prompt detection of unauthorised or malicious activities by both internal and external parties.

The SecOps team advanced security tools to conduct continuous checks on devices and systems. Immediate investigations are carried out whenever suspicious or malicious threats are detected by monitoring tools.

In 2024, there were no major cybersecurity breaches reported to the authorities. iFAST Corp remains committed to achieving zero major cybersecurity incidents and will continue to enhance its cybersecurity framework to protect its customers from evolving cyber threats and risks.